By production, we generally mean the act or process of making goods or services that has some economic value to the consumers or other producers. The production process is carried by employing various factors of production. Human labour and capital or machinery form the most basic of these factors of production.

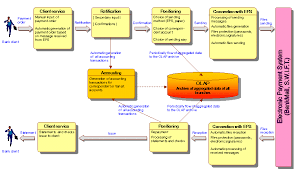

However, in order that the production process runs smoothly and efficiently, there is a need for planning, implementation, and control of industrial production processes. Production management techniques are used in both manufacturing and service industries.

Production management responsibilities include the traditional “five

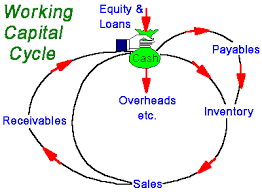

M's”: men and women, machines, methods, materials, and money. Managers are expected to maintain an efficient production process with a workforce that can readily adapt to new equipment and schedules. They are responsible for managing both physical (raw) materials and information materials (paperwork or electronic documentation). Of their duties involving money, inventory control is the most important. This involves tracking all component parts, work in process, finished goods, packaging materials, and general supplies. Managers must also monitor operations to ensure that planned output levels, cost levels, and quality objectives are met.

M's”: men and women, machines, methods, materials, and money. Managers are expected to maintain an efficient production process with a workforce that can readily adapt to new equipment and schedules. They are responsible for managing both physical (raw) materials and information materials (paperwork or electronic documentation). Of their duties involving money, inventory control is the most important. This involves tracking all component parts, work in process, finished goods, packaging materials, and general supplies. Managers must also monitor operations to ensure that planned output levels, cost levels, and quality objectives are met.This process of management can be broken down into three steps:

• First, management establishes a plan. This plan becomes the road map for what work is going to be done.

• Second, management allocates resources to implement the plan.

• Third, management measures the results to see how the end product compares with what was originally envisioned.

Most management failings can be attributed to insufficient effort occurring in one of these three areas.

Management also includes recording and storing facts and information for later use or for others within the organization. Management functions are not limited to managers and supervisors. Every member of the organization has some management and reporting functions as part of their job.